AXA Platinum Travel Insurance - 2025 Review

AXA Platinum Travel Insurance

10

Strengths

- Strong Insurance Partner

- Good Comprehensive Benefits

Weaknesses

- Not Always Available For Every Trip

Sharing is caring!

AXA is a French multinational insurance company headquartered in Paris. It provides investment management and other financial services besides travel insurance.

Despite being written by the company in upper case, "AXA" is not an acronym. It was chosen because its name can be pronounced easily by people who speak any language.

What is the AXA Platinum Insurance Plan?

Three plans are offered by AXA: Silver, Gold, and Platinum. All three policies are underwritten by Nationwide Mutual Insurance Company, a well-respected insurer in the travel insurance industry.

The Platinum plan, which we will be reviewing in this article, is an excellent plan for both international and domestic travel. The plan provides $250,000 of emergency medical coverage and $1,000,000 of emergency medical evacuation.

TravelDefenders recommends having a minimum of $100,000 for medical coverage and a minimum of $250,000 for medical evacuation for international travel. As the Platinum plan provides amounts above our international recommendations, the coverage is adequate for either domestic or international travel.

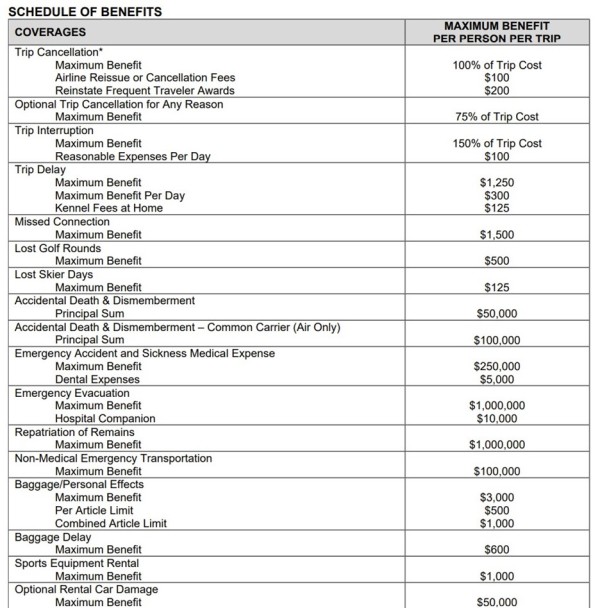

Below is a listing of the benefits for the policy:

AXA Platinum Benefits

Maximum Limits Per Person

Trip Cancellation - 100% of Trip Cost up to $50,000 per traveler

Trip Interruption - 150% of Trip Cost up to $75,000 per traveler

Travel Delay - $1250 ($300 per day after an initial delay of 12 hours or more)

Missed Connection - $1,500 (after an initial common carrier delay of 3 – 12 hours)

Baggage & Personal Effects - $3,000 ($500 per article up to $1,000 combined article limit)

Baggage Delay - $600 (after an initial delay of 12+ hours)

Accident & Sickness Medical Expense - $250,000

Emergency Medical Evacuation - $1,000,000

Accidental Death & Dismemberment - $50,000 anytime; $100,000 common carrier

Pre-existing Condition Waiver - Available if policy is purchased within 14 days of the initial payment or deposit

Medical Coverage Type - Primary – Pays BEFORE any other coverage

Lost Skier Days – up to $125 per traveler

Lost Golf Rounds – Up to $500 per traveler

Rental Car Damage Coverage (optional) – up to $5,000 for damage to rental car

Cancel For Any Reason (optional) - 75% refund if purchased within 14 days of initial trip payment or deposit

10-Day Free Look – Take 10 days to review the policy and see if it’s right for you. If not, the policy can be canceled during this time and premium refunded.

AXA Platinum - Covered Perils

While there is an extensive list of covered perils, the main perils covered are:

Emergency Sickness/Illness/Injury/Death - Yes

Hijacking, Medical Quarantine, Subpoena or Jury Duty - Yes

Home uninhabitable due to fire, flood, burglary, or Natural Disaster - Yes

Direct involvement in a documented traffic accident while en route to your departure - Yes

Organized Labor Strike - Yes

Terrorist Incident - Yes

Inclement Weather and Natural Disaster - Yes

Revocation of previously granted military leave - Yes

Financial Default of Travel Supplier - Yes

Theft of passport or visa that prevents departure – Yes

Job transfer of over 250 miles - Yes

Mandatory evacuation ordered by government authority due to adverse weather and Natural Disaster – Yes

AXA Platinum - Additional Information

Maximum Traveler Age - 99

Pre-Existing Condition Review Period - 60 days

Premium Refunds - You may submit a cancellation request and receive a full refund within 10 days from the effective date of your coverage

Latest date plan can be purchased - 1 day before departure

24/7 Emergency Travel Assistance - Included

This is only a summary of the AXA Platinum policy. Please read the policy carefully to fully understand the coverages, terms, conditions, limits, and exclusions. Some coverages may not be available in every state. This summary does not replace or change any part of your policy. If there is a conflict between this summary and the policy, the policy will control.

Premium is based on the traveler's age and the trip cost. Rates are subject to change at any time.

You can purchase the plan at any time up to 24 hours prior to departure. Benefits will apply as per the terms and conditions of the policy.

Frequently Asked Questions

What if I buy the policy and decide the coverage isn't right for me?

If you are not completely satisfied with the travel insurance you have purchased, you can call to cancel within 10 days of the effective date. AXA Travel Insurance will cancel the policy and refund your premium as long as you have not yet departed on your trip, nor submitted a claim.

This refund policy is known as the Free-Look Period.

What does travel insurance provide?

Travel Insurance provides emergency assistance services if you have a problem during your trip. Travel Insurance covers the unexpected costs such as having to cancel or interrupt your trip due to unforeseen reasons, such as the illness of you, a family member, or a travel companion, severe weather, missed connections, strikes, default of travel supplier and other unexpected events that may arise before or during your trip. Plans include trip cancellation and interruption, accident and sickness with assistance services, medical repatriation, baggage coverage, accident insurance, travel accident insurance, and many other benefits.

If I already have medical coverage, why do I need to pay for it again within travel insurance coverage?

Travel Medical Expense is designed to cover expenses for accidental injury and sickness occurring on your trip. This benefit provides coverage for medically necessary care that may not be covered on your health insurance plan.

You should check with your health insurance provider to verify if you are covered outside of the plan area or the US. This travel insurance also includes valuable 24/7 emergency assistance to aid with locating medical care, medically necessary transportation, and arranging payment for medically necessary care.

Besides medical, what other assistance is provided?

If your trip is extended on the order of a physician due to an illness or accidental injury incurred while traveling, the policy may cover hotel and meal expenses under the Trip Delay benefit, as well as additional airline transportation costs.

Travel assistance services can also help you with many other tasks, such as arranging for forgotten or damaged prescription medication, locating a doctor, and ensuring you are receiving the right care for a medical emergency.

The multilingual assistance staff can provide you with helpful information and advise you where to go if you lose your passport, need cash or legal services at your destination.

What is a Pre-existing Condition?

A Pre-existing medical condition means any accidental injury, sickness, or disease you, your traveling companion, or your family member booked to travel with you has for which medical advice, diagnosis, care, or treatment was recommended or received within 60 days prior to the policy effective date. In other words, any change in your health history in the past 60 days prior to policy purchase.

Illnesses or conditions controlled with medication where the dosage or prescription hasn’t changed in the 60-day period ending on the effective date are considered stable and not considered pre-existing conditions.

Can the Pre-Existing Condition Exclusion be waived?

Yes. The AXA Platinum Plan provides a Pre-Existing Conditions waiver if the policy is purchased within 14 days of the initial trip payment or deposit.

What events are covered under Trip Interruption?

Typically, an insured can interrupt their trip for the same or similar reasons as they can for canceling their trip. Trip Interruption differs because it provides coverage once you depart for your covered trip.

The insured will be reimbursed for prepaid, unused, and non-refundable travel arrangements plus additional transportation costs to catch up to their trip or return home early.

Is baggage loss covered?

Yes. The company will reimburse you up to $3,000 ($500 per article up to $1,000 combined article limit), if you sustain loss, theft or damage to baggage and personal effects during the trip, provided you have taken all reasonable measures to protect, save and/or recover the property. The baggage and personal effects must be owned by you and accompany you during the trip. The police or other authority must be notified within 24 hours in the event of theft.

This coverage is subject to any coverage provided by a Common Carrier.

Similar to a homeowners’ policy personal property coverage, there is a combined Maximum Benefit limit shown on the Confirmation of Coverage for the following: jewelry; watches; articles consisting in whole or in part of silver, gold or platinum; furs; articles trimmed with or made mostly of fur; cameras and their accessories and related equipment.

The company will pay the lesser of the following:

(a) Actual Cash Value at time of loss, theft or damage to baggage and personal effects; or (b) the cost of repair or replacement in like kind and quality.

What does Baggage Delay cover?

The company will reimburse you for the expense of necessary personal effects, up to the Maximum Benefit shown on the Confirmation of Coverage, if Your Checked Baggage is delayed or misdirected by a Common Carrier for more than 12 hours, while on a trip.

You must be a ticketed passenger on a Common Carrier.

Additionally, all claims must be verified by the Common Carrier, who must certify the delay or misdirection and receipts for the purchases must accompany any claim.

What does the Trip Delay cover?

The company will reimburse you for covered expenses on a one-time basis, up to the maximum benefit shown on the confirmation of coverage ($300 per day per traveler up to a maximum of $1250 per traveler), if you are delayed, while coverage is in effect, en route to or from the trip for 12 or more hours due to a defined hazard.

Covered Expenses:

- Any prepaid, unused, non-refundable land and water accommodations.

- Any reasonable additional expenses incurred.

- An economy fare from the point where you ended your trip to a destination where you can catch up to the trip; or

- A one-way economy fare to return you to your originally scheduled return destination.

- Kennel fees at home up to $125 if you are delayed in returning home

Can I buy travel insurance after an incident has occurred?

Unfortunately, no. Travel insurance coverage applies only to unforeseen issues that occur after the policy is in effect. Insurance does not cover events that are no longer unexpected or unforeseen.

What is considered an Accident?

An accident is defined as a sudden, unexpected, unusual, specific event that occurs at a specific time and place during the covered trip and also includes a mishap to a method of transport in which you are traveling.

Are there any coverage exclusions?

Yes. The complete list of coverage exclusions is summarized in the certificate. Please read the certificate carefully and note all exclusions and state exceptions that may apply.

When does the coverage begin?

All coverage except trip cancellation and optional trip cancellation for any reason will begin on the scheduled departure date, or the actual departure date if a change is required by a common carrier (or an alternate travel arrangement if required to reach your trip destination). Coverage will not begin before the effective date shown on your purchase confirmation.

Trip cancellation and optional trip cancellation for any reason coverage will begin on your effective date. No coverage can be purchased after a person departs on a trip.

What is AD&D – Common Carrier only?

The company will pay benefits for accidental injuries resulting in a loss as described in the table of losses listed in the policy, that occur while you are riding as a passenger in or on, boarding or alighting from, any air transportation operated under a license for the transportation of passengers for hire during the trip. The loss must occur within one hundred eighty (180) days after the date of the accident causing the loss. The principal sum is shown on the schedule of benefits.

Complete details of coverage terms, limitations, and exclusions that may affect benefits payable are summarized in the certificate. Please read the certificate carefully and all state exceptions that may apply.

How can a traveler get assistance while on a trip?

For 24/7 Emergency and Travel Assistance Services Only:

From within the United States: 1-855-327-1442

Outside the United States: 1-312-935-1719

Email: ustravel@axa-assistance.us

How do I file a claim with AXA?

Written notice of a claim must be given by the claimant (either You or someone acting for You) to the company or its designated representative within seven (7) days after a covered Loss first begins.

Notice should include Your name and the Plan number. Notice should be sent to the company's administrative office, at the address shown on the cover page of the policy, or to the company's designated representative.

To report a new claim, obtain claim forms or check claim status:

Within the US: 1-888-957-5015

Outside the US: 1-727-450-8794

You can download claim forms on AXA’s website: https://axatravelinsurance.com/file-a-claim

The claim form can be uploaded onto the AXA Claim portal at: https://cbpconnect.com

For Claim Status, please contact (888) 957-5015 or use the Claims Portal.

Email: axaclaims@cbpinsure.com

Mail claim form and all necessary documents to:

Attention: Co-ordinated Benefit Plans, LLC on Behalf of Nationwide Mutual Insurance Company and Affiliated Companies

PO Box 26222

Tampa, FL 33623

Can I purchase this plan cheaper directly through AXA?

No, US law prohibits different pricing for the same policy, so you can rest assured that the price you see is the lowest price possible.

Conclusion

We find the AXA Platinum Plan to be a robust policy worth considering for domestic and international travel.

It includes excellent Medical Insurance ($250,000) and excellent Medical Evacuation ($1,000,000) with a generous list of Cancellation and Interruption reasons.

The insurance also includes toll-free, 24/7 multilingual emergency assistance services to help arrange any care you may need while you are away from home.

TravelDefenders – Travel Insurance Marketplace

TravelDefenders is a travel insurance marketplace, which means that we compare your travel insurance options through multiple insurers. We are very selective about the plans we offer on our site.

You'll always find the lowest possible price and value right here at TravelDefenders.

Visit TravelDefenders first to see your options before committing to the first travel insurance policy you're offered. Stop by and chat, send an email, or give us a call at +1(786) 321 3723.

Safe travels!

This article has been written for review purposes only and does not suggest sponsorship or endorsement of AARDY by the trademark owner.

Recent AARDY Travel Insurance Customer Reviews

customer

Very easy to understand

Very easy to understand; very fast response; very friendly

Paul

Katrina offered to convert a chat to a…

Katrina offered to convert a chat to a phone call so all questions could be answered promptly. Amanda explained all the facets of the policy that were of greatest importance to us, and completed the transaction by phone. It was quick and easy.

Anthony Hoffmann

Melanie

Melanie, the Representative I was dealing with, was excellent. She was knowledgeable and attentive to my needs. She explained to me my options and help me pick the policy that best met my needs. I felt supported.