Emirates Travel Insurance - 2025 Review

Emirates Travel Insurance

6

Strengths

- Available at Check-Out

Weaknesses

- Very Expensive

- Weak Benefits

- Insufficient Travel Insurance Cover

Sharing is caring!

Emirates is one of two flagship carries of the United Arab Emirates and is based in Dubai. It is a subsidiary of the Emirates Group, which is owned by the government of Dubai’s Investment Corporation of Dubai.

When booking a flight on Emirates from the US, travel insurance is offered at checkout. We’ll take a look at the insurance offered and then compare it to what is available on the open market. But first let’s book a trip on Emirates.

Our Sample Flight – San Francisco to Dubai

For our review, we booked a trip for two travelers from San Francisco to Dubai from December 12 – January 2.

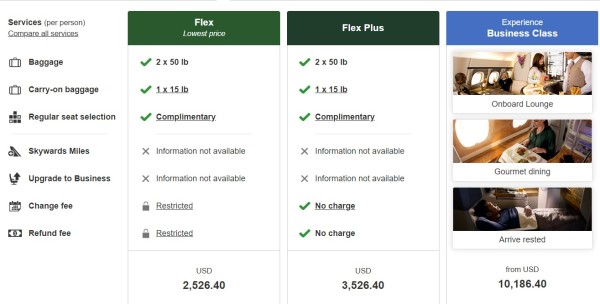

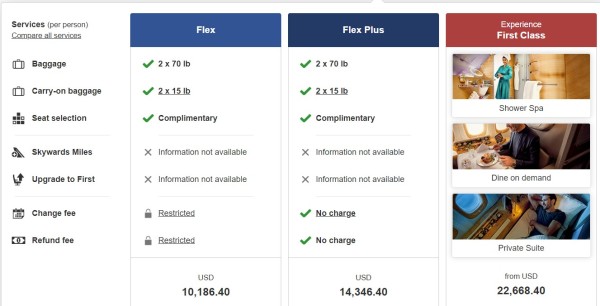

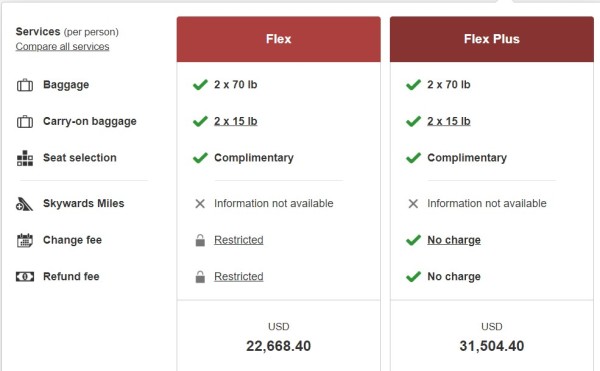

To their credit, Emirates makes it very simple for a traveler to compare the benefits of different fare seats.

For each fare type, you have two choices: Flex or Flex Plus. The main differences (besides the price) are the fees charged for changing the ticket or for refunds.

Flex Plus does not charge penalty fees for changes or refunds for any fare class. However, with Flex fares there are various fees depending on the type of cancellation and fare class.

Economy Flex charges change fees of $400 if the traveler no shows before departure and $600 for no-shows after departure. They charge different fees if requesting a refund prior to departure or after departure. Prior to departure the fee is $400 but after departure is $800.

Flex

Business Flex charges a flat fee of $800 if the traveler no shows either before or after departure. They charge different fees if requesting a refund prior to departure or after departure. Prior to departure the fee is $800 but after departure it is $1,400.

Finally, First-Class Flex charges change fees of $400 if the traveler no shows before departure and $800 for no-shows after departure. They charge the same fees if requesting a refund prior to departure or after departure.

The least expensive fare was the Economy Flex at $2,526.40. The least expensive Business seat came in at $10,186.40, while the least expensive First-Class seat was $22,688.40. That’s a huge price difference!

After reviewing the various fares, we opted for the Economy Flex for our departure but had to upgrade to Economy Flex Plus for the return leg as Economy Flex was sold out.

Total cost before seat selections and any other options is $7,853.

When you choose trip details, Emirates shows you the total cost based on the fare type chosen but also allows you to upgrade if desired.

Later, we’ll show you how to turn the Non-Refundable ticket into a Refundable one and have maximum cancellation flexibility. If possible do NOT buy a Refundable ticket!

After choosing our seats at an additional $120 cost, our trip cost increased to $7973. But before we check out, we’re offered one final option – travel insurance.

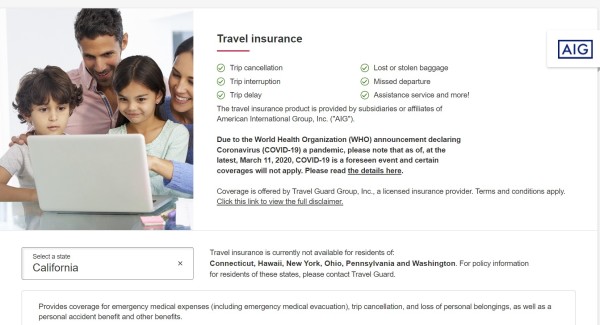

Emirates Travel Insurance – AIG Air Ticket Plan

We are used to being offered travel insurance upon check-out whenever we buy a flight. Emirates is no different and offers the AIG Deluxe Airline Ticket Protection Plan for its US customers. Note that this is NOT travel insurance – it is air ticket protection. Travelers would be well advised to seek actual travel insurance in the open marketplace to fully protect their trip.

The policy is not available in Connecticut, Hawaii, New York, Ohio, Pennsylvania and Washington. This is worrying. Almost every trip insurance policy that we see is available in all 50 states and DC.

Let’s look at the benefits.

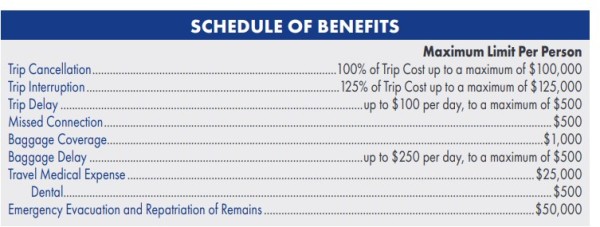

The policy provides only $25k for Medical Expenses and only $50k for Emergency Medical Evacuation. These amounts are quite low and certainly would not be sufficient for most international travelers, in our opinion.

The cost of the insurance is $480.60, which is expensive considering the limited coverage provided.

Let’s see what we can find on the open marketplace.

TravelDefenders – Compare and Save

At TravelDefenders we are a travel insurance marketplace and get binding insurance quotes, anonymously, from all our major travel insurance carriers and present them in an easy-to-read format.

Inputting our trip details for a quote, we were presented with 27 options for travel insurance. How do we determine which one to choose?

For travel to Asia, Africa, and destinations far from US shores, TravelDefenders recommends having a minimum of $100,000 of medical coverage and a minimum of $500,000 for medical evacuation coverage.

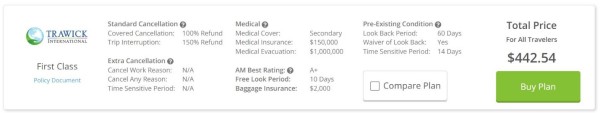

The least expensive option that provides adequate coverage is the Trawick First Class. This policy provides $150k of medical coverage and $1 million of medical evacuation coverage as well as a waiver to cover pre-existing medical conditions if the policy is purchased within 14 days of the initial trip payment or deposit date.

Total cost for the Trawick policy is $442.54, about $40 less than the AIG policy and has significantly better coverage! The policy will also allow us to cancel for standard reasons such as illness or injury prior to departure and receive a 100% of our non-refundable trip costs. Unlike Emirates, Trawick doesn’t charge a penalty if we need to cancel the trip or change trip details.

Cancel for Any Reason (CFAR) Policies

You may recall earlier we talked about not purchasing a refundable ticket. We can use travel insurance to buy a non-flexible ticket but enjoy flexible benefits. Cancel for Any Reason policies will give us this flexibility.

This is a super-powerful benefit that does exactly what it says. A traveler needs to have no reason at all to cancel and still receive a significant refund. The policies that we have can provide either a 50% or a 75% refund depending on the policy chosen.

Looking at our quote from TravelDefenders, the least expensive CFAR policy with adequate coverage is the John Hancock Silver (CFAR 75%). This policy provides $100k of medical benefits and $500k of medical evacuation benefits as well as a waiver to cover pre-existing medical conditions if the policy is purchased within 14 days of the initial trip payment or deposit date. Total cost for both travelers combined is $732.

If we cancel prior to departure for a reason listed in the policy, such as illness or injury, we will receive a 100% refund of our trip costs. However, if we decide to cancel for any reason NOT listed in the policy, such as simply deciding not to travel, we’ll receive a 75% refund of our trip costs.

The use of Cancel for Any Reason insurance to lower ticket prices has been described as the Airline Ticket Hack. Refundable benefits, yet with Non-Refundable Ticket costs.

In this way, we can purchase a lower-priced ticket yet have maximum flexibility for cancellation without the penalty fees Emirates charges.

TravelDefenders – One Site – Many Carriers

We love Amazon and are fans of Expedia. Comparison-shopping is simple. Sites like TravelDefenders do the same for travel insurance. Would you like to visit each travel insurance carrier directly? Of course not. Take the Amazon-like travel insurance experience at TravelDefenders.

The beauty of insurance comparison through a marketplace like TravelDefenders is that you get to see all the best prices in the market and make an informed decision.

Does TravelDefenders Charge More?

You won’t find the same trip insurance plans available at a better price – price certainty is guaranteed because of anti-discriminatory insurance law in the US. Take a look at the article Travel Insurance Comparison – Will I Pay More Buying Travel Insurance from a Comparison Website? This is powerful consumer protection.

A travel insurance marketplace like TravelDefenders will offer a multitude of different plans from some of the most respected travel insurance carriers in the country. You will only need a few minutes to check value for money, coverage, and insurance carrier ratings.

Enjoy your next trip Emirates and don’t forget your travel insurance.

Safe travels!

This article has been written for review purposes only and does not suggest sponsorship or endorsement of AARDY by the trademark owner.

Recent AARDY Travel Insurance Customer Reviews

Michael Fieger

🌟🌟🌟🌟🌟

🌟🌟🌟🌟🌟 I had an amazing experience with Nydia from Travel Defenders! She was professional, knowledgeable, and incredibly patient. Nydia took the time to explain all my travel insurance options clearly, making sure I fully understood my coverage. She listened to my concerns, tailored her recommendations to my specific travel plans, and made me feel truly valued. Her calm, friendly voice and attention to detail gave me complete confidence in my decision. Nydia’s service went above and beyond—she’s a true asset to the team. I highly recommend speaking with her for any travel insurance needs. Five stars without hesitation!

Barbara from California

chatting was efficient

chatting was efficient employee was very helpful

Peter Ward

fast service

fast service, fair price